2020 was a rough year for everyone.! I was definitely happy to see it end. But, It wasn’t all bad. 2020 did have some good things that happen as well. In 2020, I started Financial Coaching. I saw my daughter, Nalah, through completing her associate’s degree and receiving her high school diploma. I helped my wife launch her Needle & Curves sewing Facebook page (She has since also created a Youtube channel. And, I also finished several multi-book series with my son, Nolan. So, no, 2020 was not all bad. I, for one, will claim it as a win!

As we hit the middle of 2021, I wanted to share the 5 books that got me through the trauma that was 2020. As I started going through each of the books that I completed, I realized there was only one financial book on my list. It didn’t make my top five list, nor was it a book I would consider recommending. So the Bonus sixth book is the financial book that I recommend that anyone read in any year.

I’d love to hear about the books that got you through the early stages of the COVID-19 pandemic.

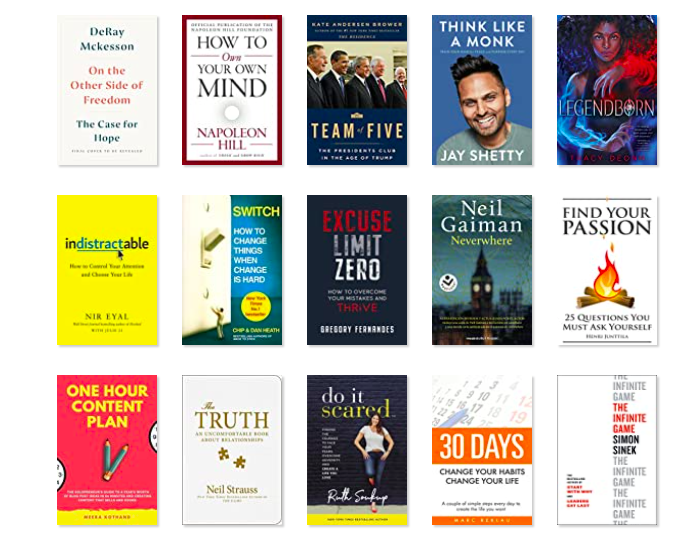

Corey’s Top 5 Books from 2020

- The 10X Rule

2. Crush It

3. Cant Hurt Me: Master your Mind and Defy the Odds

4. Greenlights

5 Excuse Limit Zero

Bonus Financial book

6. The Richest Man in Babylon

You must be logged in to post a comment.