In 2020, my wife and I sat among other eager parents and prospective students in an information session at Wichita State University. My mind was a whirlpool of numbers as I considered how we were going to afford to pay it all. As you recall, 2020 was ruled by the COVID-19 pandemic and robbed people of all kinds of joy. Many people and families were devastated, and many lost their lives. As for our family, it had already robbed my daughter of many pivotal moments, including prom, graduation, and a “normal” transition out of high school. I was determined not to let college become another casualty.

How did it begin? We definitely did not do this all at once!

For anyone who knows my wife, Michelline, and me, it was a foregone conclusion that our children were college-bound. My wife was pregnant with our daughter when she graduated college, my daughter attended college classes with me as a toddler, and in the years to come, both kids were in attendance when we both earned graduate degrees.

Going back to the college information session, as the university representatives spoke about their programs and opportunities, I could see the excitement in Nalah’s eyes. But the daunting figures in the tuition section of the pamphlet kept pulling me back to reality. Our financial journey had been long, and like many hopeful parents, we had “some” money saved (emphasis on the word some), but we didn’t have anywhere near what we needed to pay the $42,952 per year in tuition. I didn’t know much, but one thing was certain: Nalah was going to graduate college debt-free. I needed to make this work not just for her but for myself.

The Plan … be strategic

Freshman year for our daughter was not her first semester of college. In fact, by the time she started classes at Wichita State, she had already earned an Associate’s degree, which was earned while still in high school and also paid for by graduation. So, how did we do it all? I’ll break it down for you below.

Begin with the end in mind

We started this process by taking advantage of the lower tuition cost associated with enrolling in the community college program afforded to our daughter at her high school. For those students enrolled in the Early Academy program at the community college, the tuition was slightly lower than if you were a traditional college student. By completing that program, our daughter finished her Associate’s degree at a discounted rate. That was the first point of savings. We also took advantage of scholarships that were made available for military kids at the time. I’ll note here that the scholarships received were not large sums of money. In fact, it was a few hundred dollars here and there, but EVERY PENNY COUNTS! For the remaining tuition, my wife and I took advantage of the payment plan that the school offered and stuck to the plan until graduation. We did not deviate from it.

Scholarships

Here in the state of Kansas, there are merit scholarships tied to ACT scores. The higher the score, the higher the scholarships. Our daughter begrudgingly took the test three times in order to get a score high enough for an $8,000 scholarship over four years. That’s free money that essentially amounted to one year of free tuition, more or less. As you can imagine, she did not want to take the test a third time, but $8,000 is $8,000, and that money was needed since we had already dipped into our college savings to fund her associate degree. The merit scholarship was money that would be applied to the tuition at Wichita State once she enrolled in the four-year program as a true freshman (so no gap year allowed).

Another note about scholarships … sadly, we did not get any more that was directly tied to tuition, but she did later get some more funding, which allowed her to complete a study abroad in Costa Rica (I’ll write about that another time). We tried to convince our daughter to continue applying for additional scholarships, but truthfully, she didn’t really want to, and begrudgingly, we accepted that, but with a caveat … help pay the tuition with employment.

Note from Nalah – I DID!! It was just a lot of work… and I didn’t have the bandwidth for it.

Living at home, payment plans, student loans, student employment, building credit

This heading is long, but all of these things happened at once and worked together. The first was the decision to live at home. Wichita State is less than 30 minutes from our home, so living at home instead of the dorms was a HUGE cost saving– more than half of the yearly total. I’ll admit that living at home was not part of our dream for our kids, but of the Kansas State universities, the hometown university was the only one to offer Animation, our daughter’s desired major. So, living at home was ultimately the best option. Next was the acknowledgment that the kids would need to have some skin in the game despite our commitment to paying their tuition. What that meant for us was an agreement with the kids that we’d pay 2/3s of their college tuition, and they’d pay the remaining 1/3. So, if they didn’t want to apply for additional scholarships to cover their third, then they’d have to find a job and save their money so that they could pay their portion of the tuition.

The plan was to use what we had saved to pay for the first semester’s tuition and save during that semester to pay the second semester’s bill. With this plan in place, applying for student loans was a last resort. Well, as we all know, it’s great to have a plan, but things don’t usually work out the way we envision them.

Our plan hit a roadblock right away during the second semester when we missed the payment plan deadline. At this same time, Nalah expressed a desire to start looking for her own apartment and did the research on how to make that happen. Here is where we accepted that our kid would need a credit history, and resolved to help her gain one without using a credit card. We adjusted our plan and applied for student loans to cover part of the tuition, but we did so directly through the university. We DID NOT go to our bank. We made a commitment to our child that we’d pay the loan while she paid her ⅓ in cash from the money that she earned. For our part, we were committed to making all payments on the loan throughout the semester, with the goal of having it paid by the end of the semester. This ensured timely payments of the semester’s tuition and gave Nalah a head start in building a good credit history.

Life, as it usually does, threw us curveballs in the form of unexpected expenses. We had to navigate through a surprise tax bill, HVAC repairs, car maintenance, and plumbing nightmares. Our emergency fund took several hits, but we didn’t waver. Nalah’s graduation was on the horizon, and we were hell-bent on getting there debt-free. The key here was that we had an emergency fund to help get us through many of these unforeseen challenges.

Nalah, being the determined young person she is, juggled multiple part-time jobs and sold her artwork to cover her share of the tuition (you can buy her artwork here ). Through sheer determination and resilience, Nalah graduated in December 2023 with a Bachelor of Applied Arts in Animation and a minor in Communication, a semester ahead of schedule. As we celebrated this monumental achievement with our loved ones, the sense of pride that I felt was overwhelming.

Why Did this work?

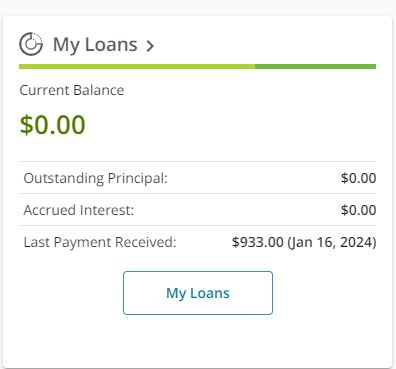

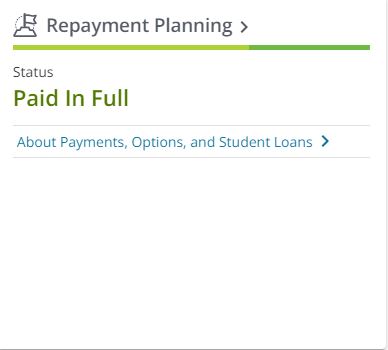

Despite the many hurdles, we paid the last payment on Nalah’s student loan 29 days after graduation. This worked for a couple of reasons. First, we did the work on the front end (all the way back when we saved just a few thousand dollars for our baby’s college education using a Coverdell 529 college fund). Second, we realized that the monthly cost of tuition at Wichita State was actually very similar to our monthly childcare cost when our kids were babies, and we were paying for daycare for two kids at once (talk about a full circle realization … This realization really made our plan seem doable). Third, we ensured that our child chose an affordable college with IN-STATE tuition. Fourth, we reframed and adjusted our idea of what a traditional college life would look like for our child. We had to let go of the dream of dorm life and resolved that living at home didn’t have to mean a less enjoyable college experience (also another discussion for another day). Finally, the 2008 decision to live without credit card debt and stay that way meant that we had access to a significant amount of our salaries after we paid our household expenses. The bottom line is that we did the work early so that we could focus our resources on paying for college.

As we reflected on what it took for us to get here and also celebrated the fact that we were able to get our first child through college, we are overjoyed by the fact that she will be unburdened by student loan debt in a time when many are struggling to pay loans that they’ve carried for more than 20 years. Nalah is ready to step into the next phase of life—and we are ready to repeat the process for our next child, who, by the way, is a freshman at Wichita State and following the same guidelines established by his sister. Wash, rinse, and repeat!

So, how much did we actually pay? Here’s the breakdown:

| Description | Cost | Scholarships | Loans | Nalah Paid | We Paid (Less Loans) |

| Associates Degree | $19,376 | $2,000 | $0.00 | $7,125 | $10,250 |

| Bachelors | $45,376 | $12,404 | $14,031 | $6,314 | $12,627 |

| Totals | $64,752 | $14,404 | $14,031 | $13,439 | $22,878 |

As you read this, if you have any questions, feel free to comment below, contact me at Corey@Corey-Stokes.com, or ask me in a message on Facebook @CoreyLStokesLLC.

Are you interested in what we do next?